This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Jan. 27, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 4:00 p.m.

Market Close

The U.S. market is now closed for the day. Happy all-time highs to those who celebrate.

The S&P 500 (+0.41%) set a new intraday high, then closed out the day at 6,978.57, good for a new record close. It’s the first record for the index since Jan. 12, made possible by a rally in tech. That same rally helped lift the Nasdaq Composite (+0.91%) nearly one percent, putting it within reach of a fresh all-time record at 23,817.10.

The Russell 2000 (+0.19%) crawled out of an intraday decline and mangled its way to a few basis points of gains. For the small cap index, the increase helped avoid a repeat day of declines, during which the index had retreated more than 2%.

The Dow (-0.83%), on the other hand, wasn’t so lucky. The index finished up just a hair above 49K as 18 of the index’s 30 strong holdings faced declines. However, the decline in UnitedHealth Group (-19.52%) was most weighty.

Health insurers paled significant declines today after the Trump Administration floated a mere 0.09% increase on government payments for private medicare plans, hammering shares of Humana (-21%), CVS Health (-14.14%), and Elevance Health (-14.33%), among others.

Controversy wasn’t exclusive to the health care space as Oracle (-4.12%) fell over four percent in response to a days-long outage on the recently-acquired TikTok US, an analyst report floating massive layoffs to bridge the gap for data center funding, and rising bids on credit default swaps (essentially, bets the company won’t pay its debt.)

American Airlines (-7%) also caught flack as the carrier struggled to recover from the recent winter storm, with Tuesday shaping up to be its worst day in the more than 100+ year history of the airline.

Separate tech talk, controversies, and upcoming earnings, the Dollar had its own troubles. Facing fresh pressure today, the Euro topped $1.20 on the greenback for the first time since 2021. Currency pressures were only exacerbated after President Trump said he “isn’t concerned” about a decline in the currency. Of course, traders were; the Dollar Index fell 1.3%, hitting 95.81.

Tomorrow’s big deal might be a repeat of the tech leadership as big tech earnings get readied up. Join our coverage tomorrow as we crack away at results from Microsoft, Meta, and Tesla, among others.

Update: 1:37 p.m.

S&P 500 Hits New Intraday Record

Past the midway point of the day, the S&P 500 (+0.47%) just set an intraday record of 6,988.82, its first since Jan. 12.

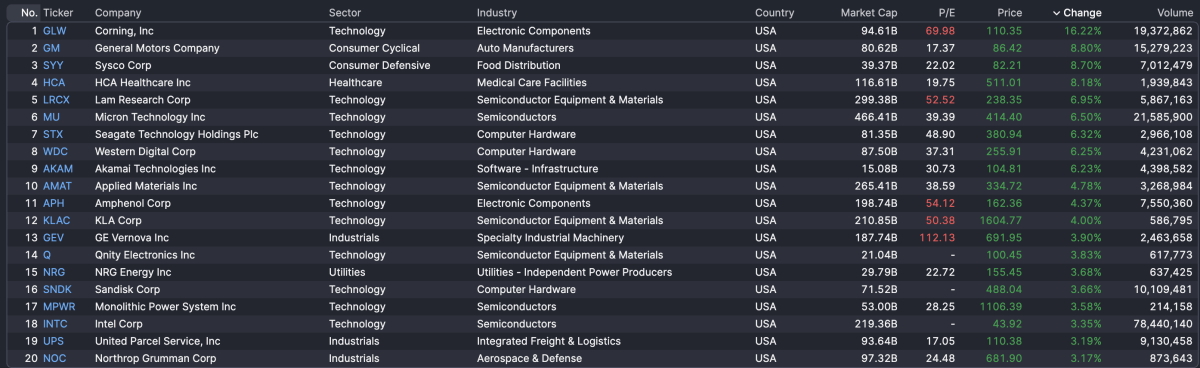

Let’s zoom in a little further on the index today; specifically, the winners. Among the index’s top-performing stocks today are Corning, Inc (+16.22%), General Motors Company (+8.8%), and Sysco Corp (+8.7%). However, not far behind, there’s the wave of tech names which are responsible for today’s excitement in the market — semiconductor and computing names like Lam Research (+6.95%), Micron (+6.5%, which announced that it would boost memory production), and Seagate (+6.32%), among others.

Also lifted by the tech-mentum, the Nasdaq (+1.01%) is over one percent higher. Meanwhile, the Russell 2000 (-0.07%) and Dow (-0.91%) are facing declines for the moment.

The Dow’s troubles can be ascribed in large part to the decline in UnitedHealth stock today, which is off nearly 20% today after the Trump Administration floated a virtually unchanged rate of reimbursement on private Medicare plans. That’s a significant decline for one of the index’s 30-strong members, which counts just 11 components in the green today.

In the S&P 500, the impact of the Medicare decision is put into context, affected health insurers such as Humana (-20.42%), CVS Health (-15.13%), and Elevance Health (-13.55%) are among the worst-performers in the index today:

Update: 11:43 a.m.

American Declines As Travel Meltdown Continues

American Airlines (-5%) is hitting day lows just hours after reporting earnings which missed expectations because of a $325 million hit from the gov’t shutdown, but at least gave investors some hope for 2026. Only, hope is in short supply today if you actually have to fly the airline.

Spillover from this week’s catastrophic winter storm has continued into today for the U.S. carrier, which has cancelled over 900 mainline flights (32%) and delayed 801 (27%) more. Today alone looks to be trending towards the worst single-day showing for the airline in its century-long history.

While the airline has faulted weather, flights from other carriers appear to be leaving from affected airports, such as New York’s LaGuardia (LGA) and Dallas Fort Worth (DFW), important operation hubs for the airline.

Update: 9:52 a.m.

Opening Bell

The U.S. markets are opened for the day. This morning, the Nasdaq (+0.81%) is nearly one percent higher, trailed by S&P 500 (+0.39%), both rising amid excitement around this week’s forthcoming tech earnings. The Russell 2000 (-0.43%) and Dow (-0.83%) are lower by contrast.

For the Dow, the decline is led by UnitedHealth (-19.1%), which is off nearly 20% after the Trump administration announced that it would keep Medicare reimbursement rates for providers nearly flat next year. Peers such as CVS Health (-11.46%) and Humana (-20.34%) are also poorly situated this morning after the announcement, which has weighed on the broader health care.

That isn’t to say it’s necessarily a tale of two markets this morning; even though tech is currently lifting the Nasdaq and S&P 500, many software and IT-facing firms are in decline again today; so too is Oracle (-3.35%), which is facing backlash for the nearly three-day outage of TikTok.

However, when you look at tech, at least pockets of strength — even ecommerce giant Amazon (+0.99%) is outpacing the broader market today on news that it will shutter its physical grocery businesses.

The strength cannot be said for health care or financials which have offered alternatives to tech supremacy. I mean, just look at the S&P 500 this morning (updated at 10:31 a.m. ET):

That all said, here is what else is on deck:

Earnings Today: RTX, UnitedHealth, Boeing

Defense contractor RTX was wheels up this morning for the largest earnings report of the day, which mostly came together for the company after a beat on revenue and profit.

It was joined by commercial aviation giant Boeing, which saw sales jump 57% year-over-year after the company delivered the most aircraft since 2018, increasing optimism about a further step-up in deliveries.

UnitedHealth has also been made to answer for the future at an awkward time, given the big Medicare announcement. Those revelations overshadowed an earnings beat and light guidance.

Here are today’s top 20 earnings, sorted by market cap:

Economic Data: Home Prices, CB Consumer Confidence, Fed Event

As investors are seen digesting this week’s big earnings, they’ll also be readying for a Fed decision… that likely will mean no change in rates. The two-day Federal Open Market Committee meeting started today and is widely expected to reveal no change in policy tomorrow afternoon.

However, there are other economic reports to dig into, including the CB Consumer Confidence for January — which fell off a cliff month-over-month, down from 94.2 to 84.5. The decline was led by a 9.9 point drop in the “Present Situation Index” and a 9.5 drop in “The Expectations Index”, which came in at 65.1, a sign that the American public polled largely expects a recession ahead.

Here’s the array of reports today: